Speak directly to the analyst to clarify any post sales queries you may have.

MARKET DRIVERS

High Consumption of Coffee: The enduring love for coffee drives the office coffee service market. Across workplaces, coffee is not merely a beverage but a daily ritual that fuels productivity, social interactions, and early morning brainstorming sessions. As employees seek their caffeine fix, the demand for coffee services remains consistently high. Companies recognize this need and invest in quality coffee provisions to keep their workforce caffeinated, motivated, and ready to tackle the day. Whether it's a robust espresso, a creamy latte, or a simple black coffee, the office coffee service industry caters to diverse tastes, ensuring the coffee cup is never empty.Rise of Co-Working Spaces: The rise of co-working spaces has transformed traditional office dynamics. These shared work environments attract freelancers, startups, and remote workers seeking flexibility, collaboration, and a vibrant community. For instance, on January 25, 2023, the U.S. General Services Administration (GSA) unveiled the Workplace Innovation Lab, a 2,5000-square-foot co-working space. OCS providers strategically position themselves within co-working spaces, recognizing that coffee is not just a beverage. It is a catalyst for networking, creativity, and productivity.

U.S. OFFICE COFFEE SERVICES MARKET HIGHLIGHTS

- The coffee segment holds the largest share, over 80%, in the U.S. office coffee services market. This dominance stems from the evolving preferences of employees who seek high-quality and premium coffee experiences in their workplace. Notably, the market is witnessing a surge in demand for specialty coffee blends, highlighting a shift towards a more sophisticated coffee culture within offices.

- The drip coffee type holds the largest market share in the coffee segment of the U.S. office coffee services market. The growth of the segment is due to its popularity and reliability. The allure of drip coffee lies in its ability to maintain a consistent flavor profile while efficiently serving large volumes. This reliability particularly appeals to workplaces with a high demand for a quick and satisfying caffeine fix. The cost-effectiveness of drip coffee further solidifies its position as an economic choice for businesses. Providing a no-frills yet satisfying coffee experience proves to be a practical solution for offices mindful of budget considerations.

- Based on the non-coffee beverage type, the other segment, which includes lemonade, sparkling water, and energy drinks, is growing prominently, with the highest CAGR of 4.95% during the forecast period. The segmental growth is mainly due to the growing popularity of sparkling water, a refreshing alternative to sugary sodas and coffee. Lemonade offers a tangy and revitalizing beverage choice, particularly favored during warmer months or as a midday pick-me-up. Energy drinks are increasingly integrated into the office beverage lineup to boost energy during long workdays or for employees facing deadlines. As a caffeinated option, energy drinks are an alternative to coffee for those seeking a productivity-enhancing beverage.

VENDOR LANDSCAPE

The U.S. office coffee services market report contains exclusive data on 35 vendors. The U.S. office coffee services market's competitive scenario is intensifying, with global and domestic players offering diverse products. Regarding market share, a few major players are currently dominating the market. Aramark Corporation, Compass Group, Keurig Dr Pepper, Peet's Coffee, and Sodexo dominate the market.In 2023, Royal Cup Coffee had a proactive approach to support through a troubleshooting video library, which signifies a shift in swiftly addressing common issues. This development emphasizes the importance of maintaining operational efficiency in office coffee equipment. Market players can respond by investing in customer support infrastructure, leveraging technology for issue resolution, and incorporating user-friendly features in their equipment to enhance overall customer satisfaction.

SEGMENTATION & FORECAST

SERVICE TYPE (Revenue)

- Coffee

- Non-Coffee Beverages

COFFEE TYPE (Revenue)

- Drip Coffee

- Espresso

- Cappuccino

- Lattes

- Others

NON-COFFEE TYPE (Revenue)

- Tea

- Juices

- Hot Chocolate

- Others

SERVICE PROVIDER (Revenue)

- Nationwide Coffee Service Providers

- Local Coffee Service Providers

- E-commerce Coffee Service Providers

END-USER (Revenue)

- Large Enterprises

- SMEs

VENDORS LIST

Key Vendors

- Aramark Corporation

- Compass Group

- Keurig Dr Pepper

- Peet's Coffee

- Sodexo

Other Prominent Vendors

- Corporate Essentials

- Daiohs USA

- InReach

- SunDun

- Coffee Ambassador

- Break Coffee

- Royal Cup Coffee

- Quench USA

- Nestlé

- Luigi Lavazza

- American Food & Vending

- Houston Coffee Services

- Bottoms Up Vending

- Café Services

- Berry Coffee

- Evergreen Refreshments

- World Cup Coffee

- US Coffee

- Office Coffee Deals

- Office Coffee Services HQ

- Cantaloupe

- Aroma Coffee

- Coffee Mill

- USConnect

- Hangar Coffee Roasters

- Capitol Vending and Coffee

- Denver Beverage

- Redcup Beverage Service

- Joyride

- Vim Coffee Catering

KEY QUESTIONS ANSWERED

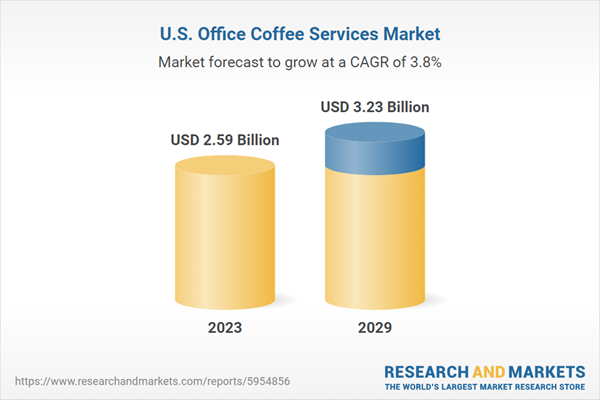

1. How big is the U.S. office coffee services market?2. What is the growth rate of the U.S. office coffee services market?

3. What are the key drivers of the U.S. office coffee services market?

4. Who are the major U.S. office coffee services market players?

Table of Contents

Companies Mentioned

- Aramark Corporation

- Compass Group

- Keurig Dr Pepper

- Peet's Coffee

- Sodexo

- Corporate Essentials

- Daiohs USA

- InReach

- SunDun

- Coffee Ambassador

- Break Coffee

- Royal Cup Coffee

- Quench USA

- Nestlé

- Luigi Lavazza

- American Food & Vending

- Houston Coffee Services

- Bottoms Up Vending

- Café Services

- Berry Coffee

- Evergreen Refreshments

- World Cup Coffee

- US Coffee

- Office Coffee Deals

- Office Coffee Services HQ

- Cantaloupe

- Aroma Coffee

- Coffee Mill

- USConnect

- Hangar Coffee Roasters

- Capitol Vending and Coffee

- Denver Beverage

- Redcup Beverage Service

- Joyride

- Vim Coffee Catering

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 77 |

| Published | April 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 2.59 Billion |

| Forecasted Market Value ( USD | $ 3.23 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 35 |