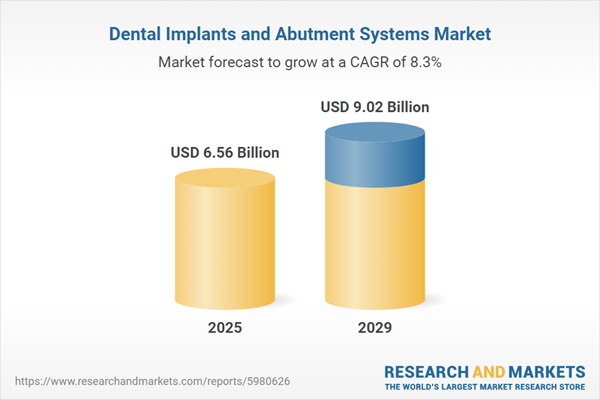

The dental implants and abutment systems market size has grown strongly in recent years. It will grow from $6.03 billion in 2024 to $6.56 billion in 2025 at a compound annual growth rate (CAGR) of 8.7%. The growth in the historic period can be attributed to rising adoption of preventive and restorative dental care by the geriatric population, favorable reimbursement policies, advantages provided by implants over other methods, robust healthcare infrastructure, increasing demand for customizable and visually pleasing implants.

The dental implants and abutment systems market size is expected to see strong growth in the next few years. It will grow to $9.02 billion in 2029 at a compound annual growth rate (CAGR) of 8.3%. The growth in the forecast period can be attributed to increasing prevalence of tooth loss, increasing awareness of dental aesthetics, high success rate of titanium implants, growing demand for dental prosthetics, increasing demand for adequate dental care and cosmetic dentistry. Major trends in the forecast period include digitalization of dental practices, increasing adoption of CAD or CAM systems and 3D printing.

The upward trend in dental procedures is anticipated to act as a significant driver for the expansion of the dental implant and abutment system market in the coming years. Dental procedures encompass a broad spectrum of medical interventions administered by dental professionals, including dentists and dental hygienists, aimed at diagnosing, preventing, or treating various oral health conditions and dental ailments. Dental implants and abutment systems are meticulously crafted to closely replicate the appearance and functionality of natural teeth. The prosthetic teeth affixed to implants are custom-tailored to harmonize with the shape, size, and color of neighboring teeth. For instance, in August 2022, as per data from NHS Digital, a UK-based governmental agency, dentists conducted 24,272 dental activities in the UK for the 2021-22 period, marking a rise of 539 activities compared to the preceding year, thereby substantiating the correlation between the surge in dental procedures and the growth of the dental implant and abutment system market.

Leading companies in the dental implants and abutment systems market are focused on advancing technologies to meet critical industry needs, with innovations like ZimVie’s next-generation TSX dental implant. Unlike typical TSX technology for enhancing haptic feedback in consumer devices, ZimVie’s TSX implant is tailored specifically for dental applications. Launched in Japan in February 2024, the TSX implant addresses immediate extraction and standard loading protocols, designed to improve placement accuracy and primary stability across various bone types. With over 20 years of clinical data backing its design, the implant supports long-term osseointegration and peri-implant health while utilizing a hybrid surface to reduce the risk of peri-implantitis. This strategic launch strengthens ZimVie’s competitive edge in the dental implant market, positioning it effectively against top-tier competitors.

In April 2023, Henry Schein, a leading US provider of dental products and services, finalized the acquisition of the S.I.N. Implant System for an undisclosed sum. This strategic move is intended to facilitate Henry Schein's expansion within the global implant market, with a specific emphasis on Brazil, a pivotal market for dental implant systems. S.I.N. Implant System, headquartered in Brazil, specializes in the manufacturing of dental implant products.

Major companies operating in the dental implants and abutment systems market report are Henry Schein Inc.; Osstem Implant Co. Ltd.; Zimmer Biomet Holdings Inc.; Dentsply Sirona Inc.; Envista Holdings Corporation; Straumann Holding AG; ZimVie Inc.; BioHorizons Inc.; Dentium Co. Ltd; Glidewell Dental Ceramics Inc.; MIS Implants Technologies Ltd.; Zest Anchors LLC; Keystone Dental Holdings Inc.; Adin Dental Implant Systems Ltd.; Cortex Dental Implants Industries Ltd; TAV Medical Ltd; Ditron Dental Ltd; Dynamic Abutment Solutions; BHI Implants Ltd.; Cowellmedi Co. Ltd; BioThread Dental Implant Inc.; Biotem Co. Ltd; Dentalpoint AG; Friadent GmbH; Ziacom Medical S.L.

North America was the largest region in the dental implants and abutment systems market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the dental implants and abutment systems market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the dental implants and abutment systems market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The dental implants and abutment systems market consists of sales of implant fixtures, abutments, prosthetic teeth or crowns, implant screws, and healing caps. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Dental implants and abutment systems serve as vital components in restorative dentistry, facilitating the replacement of missing teeth and the restoration of oral function and aesthetics. Dental implants, typically crafted from titanium, are precisely implanted into the jawbone to mimic natural tooth roots. Abutment systems, on the other hand, are connectors securely attached to implants, aiding in the support of dental prosthetics.

The key products in this domain encompass dental implants, including tapered and parallel-walled variations, as well as abutment systems comprising stock and custom abutments alongside abutment fixation screws. These products are essential for procedures conducted in hospitals, dental clinics, and other healthcare facilities. Successful outcomes and patient satisfaction hinge upon meticulous planning, precise placement techniques, and meticulous prosthetic design.

The dental implants and abutment systems market research report is one of a series of new reports that provides dental implants and abutment systems market statistics, including dental implants and abutment systems industry global market size, regional shares, competitors with a dental implants and abutment systems market share, detailed dental implants and abutment systems market segments, market trends and opportunities, and any further data you may need to thrive in the dental implants and abutment systems industry. This dental implants and abutment systems market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Dental Implants and Abutment Systems Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on dental implants and abutment systems market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for dental implants and abutment systems? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The dental implants and abutment systems market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Dental Implants; Tapered Implants; Parallel-Walled Implants; Abutment Systems; Stock Abutments; Custom Abutments; Abutments Fixation Screws2) By Material: Titanium; Zirconium; Other Materials

3) By End-Use: Hospitals; Dental Clinics; Other End Uses

Subsegments:

1) Dental Implants: Titanium Implants; Zirconia Implants; Ceramic Implants2) Tapered Implants: Self-Tapping Tapered Implants; Non-Self-Tapping Tapered Implants

3) Parallel-Walled Implants: Standard Parallel-Walled Implants; Narrow Parallel-Walled Implants

4) Abutment Systems: Implant-Supported Abutments; Overdenture Abutments; Cemented Abutments; Screw-Retained Abutments

5) Stock Abutments: Prefabricated Stock Abutments; Non-Customizable Stock Abutments

6) Custom Abutments: CAD/CAM Custom Abutments; Individually-Designed Custom Abutments

7) Abutment Fixation Screws: Titanium Abutment Fixation Screws; Gold Abutment Fixation Screws; Stainless Steel Abutment Fixation Screws

Key Companies Mentioned: Henry Schein Inc.; Osstem Implant Co. Ltd.; Zimmer Biomet Holdings Inc.; Dentsply Sirona Inc.; Envista Holdings Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Dental Implants and Abutment Systems market report include:- Henry Schein Inc.

- Osstem Implant Co. Ltd.

- Zimmer Biomet Holdings Inc.

- Dentsply Sirona Inc.

- Envista Holdings Corporation

- Straumann Holding AG

- ZimVie Inc.

- BioHorizons Inc.

- Dentium Co. Ltd

- Glidewell Dental Ceramics Inc.

- MIS Implants Technologies Ltd.

- Zest Anchors LLC

- Keystone Dental Holdings Inc.

- Adin Dental Implant Systems Ltd.

- Cortex Dental Implants Industries Ltd

- TAV Medical Ltd

- Ditron Dental Ltd

- Dynamic Abutment Solutions

- BHI Implants Ltd.

- Cowellmedi Co. Ltd

- BioThread Dental Implant Inc.

- Biotem Co. Ltd

- Dentalpoint AG

- Friadent GmbH

- Ziacom Medical S.L.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.56 Billion |

| Forecasted Market Value ( USD | $ 9.02 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |