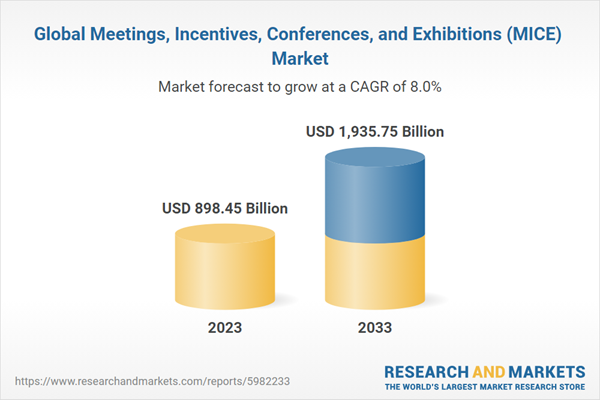

The global meetings, incentives, conferences and exhibitions (MICE) market reached a value of nearly $898.45 billion in 2023, having grown at a compound annual growth rate (CAGR) of 6.1% since 2018. The market is expected to grow from $898.45 billion in 2023 to $1.35 trillion in 2033.

Growth in the historic period resulted from the increase in business activities, increased internet penetration and rise in disposable income. Factors that negatively affected growth in the historic period include rising terrorist attacks and political instability.

Going forward, increasing government support, growth of the global population, strong economic growth in emerging markets and global surge in business trips will drive the market. Factors that could hinder the growth of the meetings, incentives, conferences and exhibitions (MICE) market in the future include increasing use of virtual meetings apps.

The meetings, incentives, conferences and exhibitions (MICE) market is segmented by event type into meetings, incentives, conferences and events. The meetings market was the largest segment of the meetings, incentives, conferences and exhibitions (MICE) market segmented by event type, accounting for 52.1% or $467.83 billion of the total in 2023. Going forward, the incentives segment is expected to be the fastest growing segment in the meetings, incentives, conferences and exhibitions (MICE) market segmented by event type, at a CAGR of 9.8% during 2023-2028.

The meetings, incentives, conferences and exhibitions (MICE) market is segmented by service type into event planning and organization, venue management, accommodation services and food and beverage services. The event planning and organization market was the largest segment of the meetings, incentives, conferences and exhibitions (MICE) market segmented by service type, accounting for 32.3% or $290.26 billion of the total in 2023. Going forward, it is expected to be the fastest growing segment in the meetings, incentives, conferences and exhibitions (MICE) market segmented by service type, at a CAGR of 9.3% during 2023-2028.

The meetings, incentives, conferences and exhibitions (MICE) market is segmented by application into e- academic field, business field, political field, exhibitions and other applications. The business field market was the largest segment of the meetings, incentives, conferences and exhibitions (MICE) market segmented by application, accounting for 65.5% or $588.33 billion of the total in 2023. Going forward, it is expected to be the fastest growing segment in the meetings, incentives, conferences and exhibitions (MICE) market segmented by application, at a CAGR of 9.1% during 2023-2028.

The meetings, incentives, conferences and exhibitions (MICE) market is segmented by organization type into large enterprises and SME enterprises. The large enterprises market was the largest segment of the meetings, incentives, conferences and exhibitions (MICE) market segmented by organization type, accounting for 72.2% or $653.17 billion of the total in 2023. Going forward, the SME enterprises segment is expected to be the fastest growing segment in the meetings, incentives, conferences and exhibitions (MICE) market segmented by organization type, at a CAGR of 8.3% during 2023-2028.

The meetings, incentives, conferences and exhibitions (MICE) market is segmented by end-user into associations, government, oil and gas, entertainment, sports, consulting and professional services, technology and telecommunications, construction, finance and insurance, healthcare and pharmaceuticals, education and academia, retail, manufacturing and mining and other end users. The government market was the largest segment of the meetings, incentives, conferences and exhibitions (MICE) market segmented by end-user, accounting for 21.9% or $196.54 billion of the total in 2023. Going forward, the technology and telecommunications segment is expected to be the fastest growing segment in the meetings, incentives, conferences and exhibitions (MICE) market segmented by end-user, at a CAGR of 11.7% during 2023-2028.

Western Europe was the largest region in the meetings, incentives, conferences and exhibitions (MICE) market, accounting for 33% or $296.26 billion of the total in 2023. It was followed by North America, Asia-Pacific and then the other regions. Going forward, the fastest-growing regions in the meetings, incentives, conferences and exhibitions (MICE) market will be Asia-Pacific and Western Europe, where growth will be at CAGRs of 9.4% and 8.8% respectively. These will be followed by North America and Eastern Europe, where the markets are expected to grow at CAGRs of 8.4% and 8.1% respectively.

The global meetings, incentives, conferences and exhibitions (MICE) market is highly fragmented, with a large number of players operating in the market. The top ten competitors in the market made up to 1.01% of the total market in 2022. Expedia Group Inc. was the largest competitor with a 0.14% share of the market, followed by ATPI Ltd. with 0.14%, Maritz Holdings Inc. with 0.13%, Flight Centre Travel Group with 0.12%, Italia Trasporto Aereo S.p.A. with 0.11%, American Express Company with 0.11%, The Freeman Company with 0.09%, GL events Group with 0.09%, Radisson Hospitality Inc. with 0.07% and Aviareps AG with 0.02%.

The top opportunities in the meetings, incentives, conferences and exhibitions (MICE) market segmented by event type will arise in the meetings segment, which will gain $241.96 billion of global annual sales by 2028. The top opportunities in the meetings, incentives, conferences and exhibitions (MICE) market segmented by service type will arise in the event planning and organization segment, which will gain $161.51 billion of global annual sales by 2028. The top opportunities in the meetings, incentives, conferences and exhibitions (MICE) market segmented by application will arise in the business field segment, which will gain $322.73 billion of global annual sales by 2028. The top opportunities in the meetings, incentives, conferences and exhibitions (MICE) market segmented by end-user will arise in the government segment, which will gain $78.33 billion of global annual sales by 2028. The top opportunities in the meetings, incentives, conferences and exhibitions (MICE) market segmented by organization type will arise in the large enterprises segment, which will gain $319.19 billion of global annual sales by 2028. The meetings, incentives, conferences and exhibitions (MICE) market size will gain the most in the USA at $107.73 billion.

Market-trend-based strategies for the meetings, incentives, conferences and exhibitions (MICE) market include launch of cutting-edge technology centers to deliver innovative services, new platforms to meet the evolving needs of event organizers, strategic partnerships and collaborations among major players and introduction of virtual and augmented reality experience technologies with new chat features.

Player-adopted strategies in the meetings, incentives, conferences and exhibitions (MICE) market include expanding business through new product developments, strengthening business capabilities through new service launches, enhancing business capabilities through strategic partnerships and strengthening business capabilities through new solutions.

To take advantage of the opportunities, the analyst recommends the meetings, incentives, conferences and exhibitions (MICE) companies to focus on technological innovation to enhance service offerings, focus on new platforms to enhance event quality, focus on VR and AR technologies to enhance event engagement, focus on expanding in the meetings market segment, focus on diversifying distribution channels for mice companies. focus on strategic partnerships to drive market expansion, expand in emerging markets, focus on strategic pricing for mice companies, provide competitively priced offerings, prioritize digital marketing channels, cultivate strategic partnerships and sponsorships, continue to use b2b promotions, focus on understanding end-user needs for targeted strategies, focus on expanding in the business field segment and focus on leveraging opportunities in the government market segment.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Meetings, Incentives, Conferences and Exhibitions (MICE) Global Market Opportunities and Strategies to 2033 provides the strategists; marketers and senior management with the critical information they need to assess the global meetings, incentives, conferences and exhibitions (MICE) market as it emerges from the COVID-19 shut down.Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Description

Where is the largest and fastest-growing market for meetings, incentives, conferences and exhibitions (MICE)? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The meetings, incentives, conferences and exhibitions (MICE) market global report answers all these questions and many more.The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s history and forecasts market growth by geography. It places the market within the context of the wider meetings, incentives, conferences and exhibitions (MICE) market; and compares it with other markets.

The report covers the following chapters:

- Introduction and Market Characteristics - Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by event type, by service type, by application, by end-user and by organization type.

- Key Trends - Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Macro-Economic Scenario - The report provides an analysis of the impact of the COVID-19 pandemic, impact of the Russia-Ukraine war and impact of rising inflation on global and regional markets, providing strategic insights for businesses in the meetings, incentives, conferences and exhibitions (MICE) market.

- Global Market Size and Growth - Global historic (2018-2023) and forecast (2023-2028, 2033F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional and Country Analysis - Historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison by region and country.

- Market Segmentation - Contains the market values (2018-2023) (2023-2028, 2033F) and analysis for each segment by event type, by service type, by application, by end-user and by organization type in the market. Historic (2018-2023) and forecast (2023-2028) and (2028-2033) market values and growth and market share comparison by region market.

- Regional Market Size and Growth - Regional market size (2023), historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape - Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major and Innovative Companies Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking - Briefs on the financials comparison between major players in the market.

- Competitive Dashboard - Briefs on competitive dashboard of major players.

- Key Mergers and Acquisitions - Information on recent mergers and acquisitions in the market is covered in the report. This section gives key financial details of mergers and acquisitions which have shaped the market in recent years.

- Market Opportunities and Strategies - Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions and Recommendations - This section includes recommendations for meetings, incentives, conferences and exhibitions (MICE) providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix - This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

1) by Event Type: Meetings; Incentives; Conferences; Events2) by Service Type: Event Planning and Organization; Venue Management; Accommodation Services; Food and Beverage Services

3) by Organization Type: Large Enterprises; SME Enterprises

4) by Application: E - Academic Field; Business Field; Political Field; Exhibitions; Other Applications

5) by End-User: Associations; Government; Oil and Gas; Entertainment; Sports; Consulting and Professional Services; Technology and Telecommunications; Construction; Finance and Insurance; Healthcare and Pharmaceuticals; Education and Academia; Retail; Manufacturing and Mining; Other End Users

Key Companies Mentioned: Expedia Group Inc.; ATPI Ltd.; Maritz Holdings Inc.; Flight Centre Travel Group; Italia Trasporto Aereo S.p.a.

Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; Italy; Spain; UK; Russia

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; meetings, incentives, conferences and exhibitions (MICE) indicators comparison.

Data Segmentation: Country and regional historic and forecast data; market share of competitors; market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Companies Mentioned

- Expedia Group Inc.

- ATPI Ltd.

- Maritz Holdings Inc.

- Flight Centre Travel Group

- Italia Trasporto Aereo S.p.A.

- American Express Company

- The Freeman Company

- GL events Group

- Radisson Hospitality Inc.

- Aviareps AG

- The China International Travel Service (CITS)

- Sinoexpo Informa Markets

- Shanghai UBM Sinoexpo International Exhibition Co., Ltd

- Messe Frankfurt (Shanghai) Co. Ltd

- Reed Exhibitions China

- Beijing CIEC International Exhibition Co., Ltd

- Shanghai Convention & Exhibition Industries Association (SCEIA)

- Shanghai New International Expo Centre (SNIEC)

- Shanghai World Expo Exhibition & Convention Center

- Thailand Convention & Exhibition Bureau

- PICO India

- Japan Convention Services, Inc. (JCS)

- Congress Corporation

- Coex Convention & Exhibition Center

- Korea International Exhibition Center (KINTEX)

- ICC Sydney

- Melbourne Convention and Exhibition Centre (MCEC)

- Jakarta Convention Center and Indonesia Convention Exhibition (ICE)

- Comexposium

- Deutsche Messe

- Messe Frankfurt

- Fira Barcelona

- IFEMA

- Stockholmsmässan

- Svenska Mässan

- MCH Group

- Palexpo

- Fiera Milano

- Fiera Roma

- Reed Exhibitions

- Informa Markets

- Expocentre

- Crocus Expo

- Romexpo

- Międzynarodowe Targi Poznańskie

- Ptak Warsaw Expo

- Prague Congress Centre

- PVA EXPO PRAHA

- Freeman

- Cvent Inc.

- GES

- BI Worldwide

- JPdL Destination Management

- Tourism Toronto

- Eventscape

- Fiesta Americana Grand Meetings Mexico

- Grupo Posadas

- Carlson Wagonlit Travel Meetings & Events (CWT Meetings & Events)

- Grupo Actidea

- Alugue Brasil

- Eventus

- Grupo Soluciones

- Kenes Group

- Messe Frankfurt Group

- Informa plc

- GL events

- MCI Group

- Hilton Worldwide Holdings Inc.

- Hyatt Hotels Corporation

- Marriott International, Inc.

- DMG Events

- The Ticketpro Dome

- Sandton Convention Centre

- Landmark Centre

- Eko Hotels & Suites

- Kenyatta International Convention Centre (KICC)

- Safari Park Hotel & Casino

- Speke Resort and Conference Centre

- Kampala Serena Hotel

- Cairo International Convention Centre (CICC)

- Egypt International Exhibition Center

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 429 |

| Published | July 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 898.45 Billion |

| Forecasted Market Value ( USD | $ 1935.75 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 81 |