Global Ski Equipment Market - Key Trends and Drivers Summarized

How Is Ski Equipment Evolving to Enhance Performance and Safety on the Slopes?

Ski equipment is continuously evolving, incorporating advanced technologies and innovative designs to enhance both performance and safety for skiers of all skill levels. Modern ski gear includes high-tech skis, boots, bindings, helmets, and apparel, each element refined to improve functionality and comfort. For instance, today's skis are made with lightweight yet durable materials such as carbon fiber and titanium, allowing for sharper turns and better control at high speeds. Boots have become more sophisticated with custom moldable liners and adjustable settings that provide a better fit, crucial for precise maneuvering and injury prevention. Bindings, too, have seen significant improvements; they are now designed to release more reliably during a fall, reducing the risk of injury. In addition to enhancing performance, modern ski equipment emphasizes safety. Helmets and protective gear are equipped with features like MIPS (Multi-directional Impact Protection System) technology, which helps reduce the rotational forces during an angled impact. These advancements make skiing more enjoyable and safer, encouraging more people to participate in the sport while minimizing the risk of injury.What Innovations Are Enhancing the Functionality of Ski Equipment?

Innovations in ski equipment are geared towards maximizing efficiency, safety, and user comfort. One of the most significant advancements is the integration of smart technology into equipment. For example, GPS-enabled goggles now provide real-time navigation, performance tracking, and even communication capabilities, allowing skiers to optimize their routes and stay connected with friends on the slopes. Another innovation is in the development of electronically adjustable ski bindings that adapt to changing skiing conditions automatically, enhancing stability and performance. Additionally, heated ski boots and gloves are becoming more popular, offering adjustable temperature controls to improve comfort in cold conditions. Apparel has also seen technological enhancements, including lightweight, waterproof, and breathable fabrics that maintain body warmth while preventing overheating, crucial for endurance and comfort in harsh weather conditions. These innovations are making ski equipment more adaptive and responsive to the needs of modern skiers, enhancing their overall experience and safety.How Do Advances in Ski Equipment Impact Environmental Sustainability?

Advances in ski equipment increasingly consider environmental sustainability. Manufacturers are adopting eco-friendly practices, such as using recycled materials for ski jackets and pants and sustainable wood cores in skis. Many companies are also reducing the use of harmful chemicals in their production processes, such as perfluorinated chemicals (PFCs) used in waterproof coatings. Additionally, the ski industry is seeing a trend towards more durable products that offer longer lifespans, reducing waste and the need for frequent replacements. Some brands have initiated take-back programs for used equipment, aiming to recycle or repurpose ski gear and reduce environmental impact. As consumers become more environmentally conscious, the demand for sustainably produced ski equipment grows, pushing the industry towards more green innovations and practices.What Trends Are Driving Growth in the Ski Equipment Market?

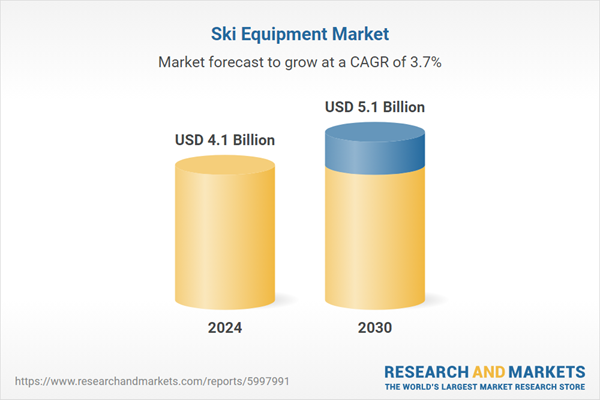

The ski equipment market is driven by trends such as an increasing interest in outdoor recreational activities, technological advancements in sports equipment, and a growing awareness of safety on the slopes. As more people seek healthy, active lifestyles, winter sports like skiing are gaining popularity, boosting demand for ski equipment. Technological innovations that enhance the safety and performance of ski gear are making the sport more accessible to beginners and more enjoyable for experienced enthusiasts, further driving market growth. Additionally, there is a rising trend in ski tourism, with enthusiasts traveling to exotic and remote locations for unique skiing experiences, which stimulates demand for high-performance gear suited to various terrains and conditions. Moreover, heightened safety regulations and awareness are prompting skiers to invest in advanced protective gear, contributing to the overall growth of the ski equipment market. These trends underscore the dynamic nature of the ski equipment industry and its adaptability to changing consumer preferences and technological innovations.Report Scope

The report analyzes the Ski Equipment market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Skis & Poles, Ski Boots, Ski Bindings, Ski Protective Gear).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Skis & Poles segment, which is expected to reach US$2.7 Billion by 2030 with a CAGR of a 4.1%. The Ski Boots segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 3.6% CAGR to reach $815.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ski Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ski Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ski Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alpina d.o.o., Amer Sports Corporation, ATOMIC Austria GmbH, Black Crows, Black Diamond Equipment Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Ski Equipment market report include:

- Alpina d.o.o.

- Amer Sports Corporation

- ATOMIC Austria GmbH

- Black Crows

- Black Diamond Equipment Ltd.

- Coalition Snow

- Decathlon UK

- Elevate Outdoor Collective Holdings LP

- Fischer Sports GmbH

- Kneissl Tirol GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alpina d.o.o.

- Amer Sports Corporation

- ATOMIC Austria GmbH

- Black Crows

- Black Diamond Equipment Ltd.

- Coalition Snow

- Decathlon UK

- Elevate Outdoor Collective Holdings LP

- Fischer Sports GmbH

- Kneissl Tirol GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 5.1 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |