This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

As more people prioritize health, fitness, and wellness, they are seeking clothing that supports an active routine. However, athleisure goes beyond the gym or yoga studio. With a focus on both comfort and aesthetics, it’s now common to see athleisure outfits in offices, coffee shops, airports, and even social events. Athleisure is more than a passing trend; it’s a reflection of a broader cultural shift toward casual, comfortable living. As work-from-home setups and hybrid lifestyles become more common, the demand for versatile clothing that can move across different aspects of life will continue to rise.

With ongoing innovation in fabric technology, design, and sustainability, athleisure is set to evolve and remain a prominent player in the fashion world for years to come. The rising trend of athleisure among all age groups is significantly boosting the demand for these products for everyday wear. The desire to be fit and healthy has resulted in consumers prioritizing garments that can seamlessly transition between various daily activities. The increasing number of individuals participating in outdoor activities, such as hiking, marathons, and camping, is one of the major factors boosting the demand for athleisure.

In October 2022, more than 40,000 runners took part in the 2022 Bank of America Chicago Marathon while more than 50,000 runners finished the TCS New York City Marathon in November 2022. This scenario is boosting the need for sports apparel and athleisure. Several manufacturers are capitalizing on this trend and offer high-profile sporty and fashionable athleisure to cater to the consumer demand for apparel that is not only suitable for a workout or the gym but is also stylish and suitable for a variety of everyday activities.

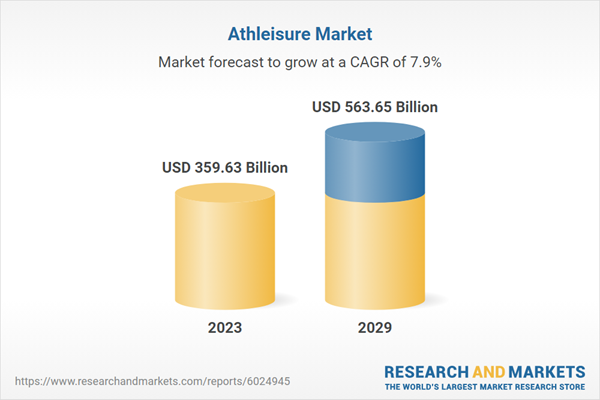

According to the research report, “Global Athleisure Market Outlook 2029” the market is anticipated to cross USD 560 Billion by 2029, increasing from USD 359.63 Billion in 2023. The market is expected to grow with a 7.94% CAGR from 2024 to 2029. Fashion has become more casual in recent years, particularly as workplaces embrace relaxed dress codes and people prioritize comfort over formality. Athleisure fits perfectly into this movement, offering style without sacrificing ease. As more people focus on fitness and maintaining an active lifestyle, they are looking for clothes that can take them from a workout session to running errands or meeting friends.

Athleisure’s versatility allows for seamless transitions throughout the day. Advances in fabric technology have made it possible to create athletic wear that looks chic while being functional. High-performance fabrics, such as those with moisture-wicking, stretchable, and breathable properties, allow consumers to stay comfortable throughout the day. With athletes and fitness influencers taking center stage in social media and marketing campaigns, athleisure has become synonymous with an aspirational, healthy lifestyle. Brands like Lululemon, Nike, and Adidas have capitalized on this trend, often collaborating with celebrities to promote their collections. Sustainability is becoming a major focus within the athleisure market.

Consumers are more conscious of the environmental impact of their purchases, leading brands to innovate with eco-friendly materials and production methods. From recycled fabrics to reducing water usage in manufacturing, the shift toward sustainable athleisure is helping the industry align with broader environmental concerns. While athleisure began as a niche trend, it’s now a significant force in the global fashion industry. Luxury brands have also embraced athleisure, incorporating sporty elements into high-end fashion collections. Designers like Stella McCartney and Alexander Wang have created lines that combine the comfort of sportswear with the elegance of couture, proving that athleisure is not limited to fast fashion or street-wear.

Market Drivers

- Rise of athletes and influencers in fashion: The influence of athletes, celebrities, and fitness influencers has played a significant role in driving the popularity of athleisure. Social media platforms like Instagram and TikTok have amplified the visibility of this trend, as influencers often promote their workout routines while wearing stylish athleisure. High-profile collaborations between fitness icons and major brands, like Lululemon or Adidas, further fuel the demand for athleisure as a fashionable lifestyle choice.

- Versatility and convenience: Athleisure’s multifunctional appeal is a major driver. Consumers are drawn to clothing that fits multiple occasions without the need for constant wardrobe changes. Athleisure outfits can transition seamlessly from workouts to casual outings, making them ideal for busy individuals seeking both comfort and efficiency. This versatility has increased the demand for stylish, all-day clothing that doesn't compromise on performance.

Market Challenges

- Maintaining fashion appeal: While athleisure is known for its comfort, balancing style and performance is a continuous challenge. Consumers expect athleisure to be both functional for physical activities and aesthetically pleasing for casual settings. As trends change quickly, brands must constantly innovate and update their designs to stay relevant in the fashion-forward market, all while ensuring that their products meet performance standards.

- Price sensitivity: Athleisure often involves advanced materials and fabric technologies, which can lead to higher production costs. Premium athleisure brands like Lululemon and Alo Yoga price their products at a premium, but this can be a barrier for many consumers. Fast fashion brands offering more affordable options further intensify price competition. Maintaining a balance between high-quality, functional products and affordability is a persistent challenge for brands in this space.

Market Trends

- Gender-neutral athleisure: An emerging trend in athleisure is the rise of gender-neutral or unisex collections. With societal shifts toward more inclusive and fluid views on gender, athleisure brands are embracing designs that appeal to all genders. The simplicity and functionality of athleisure make it ideal for unisex collections, as pieces like hoodies, joggers, and sneakers have broad appeal across demographics. Gender-neutral designs also enhance the versatility and universality of the clothing.

- Luxury athleisure: The incorporation of athleisure into high fashion is becoming increasingly prominent, with luxury designers integrating athleisure elements into their collections. Brands like Gucci and Balenciaga have added sporty silhouettes and performance fabrics to their lines, elevating athleisure to a premium fashion statement. The fusion of athletic wear and luxury aesthetics caters to affluent consumers who desire both comfort and high-end style, further broadening the appeal of athleisure across income brackets.

Clothing dominates the athleisure market because of its unmatched versatility, seamlessly blending fashion, comfort, and performance for a wide range of activities.

Athleisure clothing, such as leggings, joggers, hoodies, and performance tops, has become a wardrobe essential because it effortlessly adapts to different aspects of modern life. Whether it's going to the gym, running errands, working from home, or even socializing, athleisure clothing provides the perfect balance between style and function. These pieces are designed to offer both freedom of movement and moisture-wicking properties, making them suitable for physical activity, while their fashionable cuts and designs make them appropriate for casual or even semi-formal environments. The versatility of athleisure clothing allows consumers to streamline their wardrobes, reducing the need for multiple outfit changes throughout the day.Additionally, brands have responded to this growing demand by introducing innovative fabrics and chic designs that elevate the appeal of athleisure beyond the gym. As consumers increasingly prioritize comfort without sacrificing style, athleisure clothing continues to lead the market, appealing to a broad demographic, from fitness enthusiasts to those simply seeking a relaxed yet polished look. This multifunctional aspect of clothing makes it the most adaptable and in-demand segment within the athleisure market.

The mass category leads in the athleisure market due to its affordability, broad accessibility, and ability to cater to a wide demographic of consumers who prioritize both comfort and style without breaking the bank.

Athleisure in the mass category, offered by fast fashion retailers and mid-range brands, dominates the market because it meets the everyday needs of a large, price-sensitive audience. Unlike premium or luxury athleisure, which targets niche, high-income groups, the mass category makes stylish and functional athletic-inspired clothing accessible to a much larger population. Consumers can enjoy the benefits of athleisure, such as breathable fabrics, flexible designs, and trendy looks, at affordable prices, making it easier to integrate athleisure into their daily wardrobes.Fast fashion brands like H&M, Zara, and Uniqlo have capitalized on this trend by offering fashionable athleisure collections that mirror the latest styles at a fraction of the cost of high-end labels. These affordable options appeal not just to fitness enthusiasts but also to casual consumers who want the comfort of athleisure for everyday activities.

Additionally, the rise of e-commerce and global supply chains has made it easier for these mass-market brands to quickly deliver athleisure trends to consumers worldwide, further driving the category’s growth. As a result, the mass segment remains the most popular in the athleisure market, driven by its cost-effectiveness, accessibility, and ability to serve the lifestyle needs of a broad and diverse audience.

Women are leading in the athleisure market because the category aligns perfectly with their increasing demand for versatile, comfortable, and stylish clothing that transitions seamlessly between active, professional, and casual settings.

The dominance of women as end users in the athleisure market can be attributed to the growing need for multifunctional clothing that fits into their busy, multifaceted lifestyles. Athleisure offers women the flexibility to move between fitness activities, work, social outings, and errands without needing to change outfits. With women balancing multiple roles whether in the office, at home, or in fitness spaces the versatility of athleisure has made it a go-to choice. Brands have also recognized the increasing demand from women for clothing that offers both performance and style, responding with designs that cater specifically to their needs.From high-waisted leggings and sports bras to fashion-forward hoodies and crop tops, athleisure for women emphasizes flattering fits, comfort, and aesthetic appeal. Moreover, the rise of wellness culture and body positivity movements has driven more women to embrace active lifestyles, further boosting their interest in athleisure as both functional sportswear and fashion.

Female consumers are not only purchasing athleisure for workouts but also integrating these pieces into their everyday wardrobes, elevating athleisure from a gym trend to a mainstream fashion choice. With brands continually innovating to meet this demand, the women's segment remains at the forefront of the athleisure market, making it the largest and most influential consumer base.

Offline retail stores lead in the athleisure market because they offer consumers the opportunity to physically experience the fit, comfort, and fabric quality of athleisure products, which is crucial for making informed purchasing decisions.

While e-commerce has seen rapid growth, offline retail stores continue to dominate the athleisure market due to the tactile and experiential nature of buying athletic-inspired apparel. Athleisure products, such as leggings, sports bras, and performance tops, are designed for physical activity, making it essential for customers to try them on and assess factors like stretch, breathability, and overall fit before making a purchase. The in-store experience allows consumers to feel the fabric, test the flexibility, and ensure the clothing meets their specific body shape and comfort needs something that can be difficult to gauge through online shopping alone.Additionally, the ability to receive immediate feedback from sales associates, explore a variety of sizes and styles in person, and walk out with a purchase in hand adds to the appeal of offline shopping for athleisure. For many shoppers, the offline experience also provides a sense of assurance, as they can inspect products for quality, which is especially important in a category that merges performance and fashion.

Furthermore, the presence of dedicated athleisure sections and branded stores, like Nike, Lululemon, and Adidas, enhances the shopping experience by offering immersive brand environments that cater specifically to the athleisure customer. As a result, despite the convenience of online shopping, offline retail continues to lead in the athleisure market by providing a hands-on, personalized, and immediate shopping experience that resonates with consumers seeking comfort and performance in their clothing.

North America leads the athleisure market due to its strong fitness culture, established sportswear brands, and high consumer demand for versatile, comfortable, and fashion-forward activewear.

North America's dominance in the athleisure market is largely driven by the region's deep-rooted fitness and wellness culture, where staying active is an integral part of daily life for many consumers. With a significant portion of the population engaging in regular exercise, from yoga to running and gym workouts, the demand for high-performance, stylish activewear has surged. Additionally, North America is home to some of the largest and most influential sportswear brands, such as Nike, Lululemon, and Under Armour, which have pioneered the athleisure trend by blending athletic functionality with everyday fashion.These brands have not only set global trends but also continually innovate with cutting-edge fabrics, performance-enhancing technologies, and designs that appeal to a broad audience. The region's consumer base places a high value on versatility and convenience, seeking clothing that effortlessly transitions between workouts, errands, and social settings, making athleisure the perfect fit.

The rise of wellness influencers, celebrity endorsements, and social media promotion has further fueled the trend in North America, making athleisure a mainstream fashion category. Moreover, the relatively high disposable income in North America allows consumers to invest in quality athleisure pieces, contributing to the market’s strong growth. With a lifestyle that emphasizes health, fashion, and comfort, North America has become the epicenter of the global athleisure movement.

- In January 2024, Dick’s Sporting Goods announced its latest innovation with the introduction of the Inspire fabric for its Calia brand. This new collection caters specifically to the global market, offering a range of apparel made from the lightweight Inspire fabric, which bears resemblance to spandex but with added benefits. The collection encompasses a variety of athleisure staples, including leggings, bodysuits, dresses, shorts, tank tops, and sports bras, providing options for various activities and styles.

- In September 2023, Peloton and leading athletic wear brand Lululemon revealed a strategic five-year partnership, marking a significant development in the fitness industry. This collaboration signaled the end of Lululemon's venture into connected fitness devices, particularly its recently acquired Mirror platform. Under the terms of the partnership, Peloton will serve as the exclusive digital fitness content provider for Lululemon, while Lululemon will become the primary athletic apparel partner.

- In August 2023, Patagonia, Inc. launched its first circular T-shirt using discarded tees and cotton scraps. Tee-Cycle shirts are part of Patagonia’s commitment to creating a circular economy and are made of discarded tees destined for the landfill, with a mind to helping solve the textile waste problem.

- In June 2023, California-based activewear brand Vuori partnered with fitness equipment brand Bala to launch a limited-edition collection. This exclusive collection is only available through Vuori's website and select U.S. store locations. The move was aimed at offering fans Vuori's "California cool" aesthetic with a stylish workout accessory. The collaboration between Vuori and Bala, known for a fusion of fashion and fitness, is a natural fit and promises to resonate with consumers seeking both style and functionality in their workout gear.

- In May 2023, PANGAIA expanded its Motion collection to include a new capsule collection for men and added colorways for women. The collection features bio-based activewear made with plant-based materials, including EVO Nylon and creole elastane. The men's collection includes t-shirts, tops, and tights in volcanic grey and black, while the women's collection offers sports bras, tank tops, t-shirts, shorts, and leggings in new taupe and cobalt blue, along with existing colors. The brand's collaboration with Hyosung-a completely sustainable textile solutions provider-introduces bio-based elastane to reduce its carbon footprint.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Athleisure market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Product Type

- Clothing

- Footwear

- Other Product Types

By Category

- Mass

- Premium

By End User

- Women

- Men

- Kids

By Distribution Channel

- Offline Retail Stores

- Online Retail Stores

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Athleisure industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adidas AG

- Under Armour, Inc.

- Lululemon athletica inc.

- Hanesbrands Inc.

- Nike Inc

- VF Corporation

- Wolverine World Wide, Inc.

- ASICS Corporation

- Patagonia, Inc.

- Lululemon athletica inc.

- H & M Hennes & Mauritz AB

- Eileen Fisher Inc

- The Gap, Inc.,

- New Balance Athletics, Inc.

- Vuori

- Rhone Inc.

- Puma SE

- Fila Holdings Corp.

- Outerknown, LLC

- Columbia Sportswear Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | October 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 359.63 Billion |

| Forecasted Market Value ( USD | $ 563.65 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |