Global Lager Market - Key Trends & Drivers Summarized

What Is Lager and Why Is It Essential in the Global Beer Industry?

Lager is a type of beer that is brewed using bottom-fermenting yeast at cooler temperatures, typically between 45°F and 55°F (7°C to 13°C). Known for its crisp, clean taste and smooth finish, lager is one of the most popular beer styles worldwide, available in various subtypes such as pale lager, pilsner, amber lager, and dark lager. The unique brewing process gives lager a distinct character, with a milder flavor profile and lower yeast presence than ales. Lager is especially appreciated for its refreshing quality, making it a popular choice for casual consumption and social gatherings. Its versatility appeals to both seasoned beer enthusiasts and casual drinkers, cementing its place as a staple in the global beer industry.Lager is essential in the beer market not only because of its popularity but also due to its contribution to the diversity and evolution of beer styles. Originating in Central Europe, lager quickly spread across continents and became a global favorite due to its adaptability and compatibility with various palates. As consumer preferences evolve, brewers have innovated within the lager category, producing varieties that range from light, sessionable beers to robust, malty brews, meeting diverse tastes. Major brewing companies and craft breweries alike have embraced lager as a core product, leveraging its mass appeal and capacity for innovation. Lager's wide acceptance in different regions and cultures has made it the most consumed beer style worldwide, driving both large-scale production and niche brewing experiments.

The economic significance of lager is profound, as it drives substantial revenue and employment in the beer industry. Major brewing companies rely on lager as a flagship product, generating significant sales in both domestic and export markets. The lager market also supports a diverse supply chain, from agricultural producers of barley and hops to distributors, retailers, and hospitality sectors. Lager's cultural and economic impact extends beyond direct sales; it plays a role in social events, festivals, and tourism, enhancing its value as a globally cherished beverage. This broad consumer base and economic importance make lager a foundational category in the beer industry, supporting the livelihoods of countless businesses and communities worldwide.

How Are Consumer Trends and Innovation Shaping the Lager Market?

Consumer trends toward health-conscious, premium, and diverse beer options are reshaping the lager market, prompting breweries to adapt to meet changing demands. There is a growing preference for low-alcohol and non-alcoholic lager options, appealing to health-conscious consumers who want to enjoy the taste of beer without the effects of alcohol. This trend is especially prominent in markets such as North America and Europe, where awareness of moderation and wellness has spurred demand for lighter, more sessionable lagers. Breweries are responding by producing low-alcohol and alcohol-free lagers that retain the refreshing, full-bodied taste of traditional lagers. These options are often crafted using advanced brewing techniques that preserve flavor, allowing consumers to enjoy lager as a part of a balanced lifestyle.Innovation in premium and craft lager varieties is also shaping the market, as consumers increasingly seek high-quality and unique beer experiences. Craft breweries have introduced artisanal lagers that highlight local ingredients, creative flavor profiles, and traditional brewing methods, catering to a consumer base willing to pay more for quality. Premium lagers, often made with specialty hops or small-batch brewing processes, offer rich flavors and unique aromas that set them apart from mass-market beers. Pilsners, Vienna lagers, and specialty lagers are gaining traction in the premium segment, as they provide a sophisticated alternative for beer enthusiasts who seek authenticity and craftsmanship. The popularity of these premium lagers is driving growth in the craft beer sector, allowing breweries to experiment within the lager category and bring new styles to market.

Environmental awareness and sustainability are further influencing the lager market, with breweries adopting eco-friendly practices to appeal to environmentally conscious consumers. Many breweries are focusing on sustainable sourcing of ingredients, reducing water and energy usage, and implementing packaging innovations like recycled cans and biodegradable labels. Some brands are also transparent about their carbon footprint and invest in carbon offset programs. These efforts not only reduce environmental impact but also resonate with consumers who prioritize sustainability in their purchasing decisions. The push toward eco-friendly brewing aligns with the broader trend of responsible consumption, making sustainability a key factor in the modern lager market. Together, these trends - low-alcohol options, premiumization, and sustainability - are driving innovation, diversification, and growth within the lager segment, creating new opportunities for both large-scale and craft breweries.

Where Is Lager Making the Greatest Impact Across Market Segments?

Lager has a substantial impact across multiple market segments, including mass-market, craft beer, hospitality, and export segments, each of which has distinct consumer bases and growth dynamics. In the mass-market segment, lager dominates as the preferred choice among mainstream beer drinkers who seek affordable, consistent, and refreshing options. Major brewing companies like Anheuser-Busch InBev, Heineken, and Carlsberg produce flagship lagers that cater to a broad audience, ensuring widespread availability in bars, restaurants, and retail stores. Mass-market lagers are known for their light, crisp taste and affordable pricing, making them popular for casual consumption and social gatherings. This segment is particularly influential in regions such as North America, Europe, and Asia-Pacific, where consumers often view lager as an accessible, go-to beverage for everyday enjoyment.In the craft beer segment, lager is gaining traction as an artisanal offering that allows brewers to showcase brewing skill and creativity within a familiar style. Craft lagers are produced with attention to detail and quality, often incorporating unique ingredients or brewing techniques that differentiate them from mass-market lagers. Breweries are reviving traditional lager styles like Vienna lager, Munich Helles, and Czech pilsner, providing consumers with a refined beer experience that celebrates craftsmanship. The craft lager segment has grown particularly strong in North America and Europe, where beer enthusiasts value small-batch brewing and are willing to explore different styles within the lager category. The craft lager trend is reshaping the perception of lager, positioning it as a premium product that appeals to discerning consumers looking for something beyond standard fare.

In the hospitality sector, lager is a mainstay in bars, restaurants, hotels, and event venues, where it is frequently chosen for its universal appeal and versatility with food pairings. Lager's light, balanced flavor makes it an ideal pairing with a wide range of dishes, from appetizers and grilled meats to seafood and vegetarian fare. This versatility ensures its popularity in the foodservice industry, where it is featured on tap lists, beer menus, and event offerings. Hotels and catering services also rely on lager to meet diverse guest preferences, as it appeals to both casual drinkers and beer connoisseurs alike. The hospitality industry's reliance on lager is evident in its widespread presence at social events, weddings, sports games, and festivals, where it is enjoyed as a refreshing, sociable beverage.

In the export market, lager has become a global product with strong demand across international borders, driven by both expatriate communities and the global popularity of well-known beer brands. Major exporting countries like Germany, the Netherlands, and Mexico have established reputations for their high-quality lagers, which are distributed to markets worldwide. For instance, Mexican lagers like Corona and German pilsners have gained iconic status, becoming sought-after imports in markets such as North America, Europe, and Asia. This export demand supports the lager market's growth as brands expand into new regions, where international consumers are eager to experience imported lagers. The global appeal of lager has transformed it into an export staple that supports the economic growth of key brewing nations and contributes to the international expansion of leading brands.

What Are the Key Drivers Fueling Growth in the Lager Market?

The growth in the lager market is driven by several key factors, including increasing global beer consumption, demand for diverse and premium beer options, and the expansion of distribution networks across emerging markets. Global beer consumption is rising, with lager continuing to be the most popular style due to its light, refreshing qualities and wide appeal. Lager's versatility makes it suitable for various occasions, from casual drinking to formal events, making it a preferred choice among consumers worldwide. Growth in beer consumption is particularly strong in emerging markets in Asia-Pacific, Latin America, and Africa, where rising incomes and urbanization are driving greater demand for alcohol. As consumer bases expand in these regions, lager remains a foundational choice due to its accessibility, affordability, and established cultural relevance.The demand for diverse and premium beer options is another significant growth driver, as consumers seek more personalized and high-quality beer experiences. This trend is evident in the rise of premium lagers, which are often brewed using traditional methods and high-quality ingredients that set them apart from mass-market varieties. Consumers in mature markets, such as North America and Europe, increasingly favor craft lagers and premium imports, driving breweries to expand their offerings to include specialty lagers with distinct flavor profiles. The premiumization trend aligns with consumer willingness to pay more for quality and craftsmanship, creating new opportunities for both large-scale brewers and small craft breweries within the lager market.

The expansion of distribution networks across emerging markets is also fueling growth in the lager market. International breweries are investing in local production facilities, partnerships, and distribution channels to tap into high-growth markets. For example, major beer brands have expanded their presence in China, India, and Southeast Asia through strategic partnerships with local distributors and retailers. The global reach of online retail and delivery services has also made it easier for consumers to access a wide variety of lagers, further expanding the market. Additionally, lager brands are increasingly participating in global events and sponsorships, such as sports tournaments and music festivals, which help raise brand visibility and appeal. This expansion into new markets and increased brand visibility contributes significantly to lager's growth on an international scale.

Together, these drivers - rising beer consumption, demand for premium options, and distribution expansion - are propelling growth in the lager market, solidifying lager as a dominant and evolving category in the global beer industry. As breweries continue to innovate and reach new consumer bases, lager's importance in both local and international markets is expected to grow, reinforcing its status as a globally loved and enduring beer style.

Report Scope

The report analyzes the Lager market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Packaging Type (Glass Packaging, Metal Can Packaging, Other Packaging Types); Price Point (Premium Priced Lager, Luxury Priced Lager, Popular Priced Lager); Distribution Channel (On-Trade Distribution Channel, Off-Trade Distribution Channel, Multi-Brand Stores).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Glass Packaging segment, which is expected to reach US$258.7 Billion by 2030 with a CAGR of a 2.6%. The Metal Can Packaging segment is also set to grow at 1.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $85.5 Billion in 2024, and China, forecasted to grow at an impressive 4.1% CAGR to reach $68.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Lager Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Lager Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

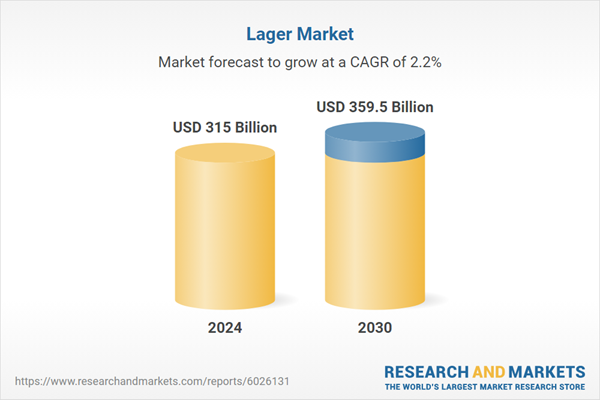

- How is the Global Lager Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anchor Brewing, Anheuser-Busch InBev SA/NV, Asahi Group Holdings Ltd., Beck's, Bira 91 and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Lager market report include:

- Anchor Brewing

- Anheuser-Busch InBev SA/NV

- Asahi Group Holdings Ltd.

- Beck's

- Bira 91

- Budweiser Budvar Brewery

- Carlsberg Breweries A/S

- Constellation Brands, Inc.

- D.G. Yuengling & Son, Inc.

- Diageo PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anchor Brewing

- Anheuser-Busch InBev SA/NV

- Asahi Group Holdings Ltd.

- Beck's

- Bira 91

- Budweiser Budvar Brewery

- Carlsberg Breweries A/S

- Constellation Brands, Inc.

- D.G. Yuengling & Son, Inc.

- Diageo PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 386 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 315 Billion |

| Forecasted Market Value ( USD | $ 359.5 Billion |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | Global |