Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

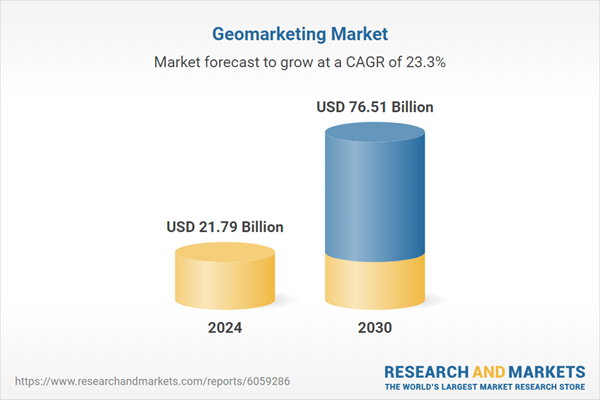

The market for geomarketing is expected to rise significantly due to several key factors. The increasing availability and sophistication of geospatial data, including real-time location data from mobile devices, GPS systems, and social media platforms, allow businesses to refine their strategies with precision. The growth of e-commerce and omnichannel marketing is pushing businesses to adopt more location-aware solutions to better reach customers in both digital and physical spaces. The proliferation of smartphones and the internet of things (IoT) also plays a pivotal role, providing businesses with valuable location-based insights that inform targeted advertising, promotions, and product recommendations.

Key Market Drivers

Increasing Availability of Geospatial Data

One of the key drivers for the growth of the Geomarketing Market is the increasing availability of geospatial data. Over the years, the amount of geographic information that businesses can access has expanded exponentially. This includes data from multiple sources such as satellites, geographic information systems (GIS), mobile devices, social media platforms, and internet of things (IoT) sensors. With real-time geospatial data, businesses can understand consumer behaviors and preferences based on their geographical location. The integration of this data into marketing strategies allows businesses to make more informed decisions about customer targeting, store placements, and personalized advertising.The growth of digital platforms has also contributed significantly to the rise of geospatial data. Every digital interaction a customer makes can potentially provide geographic insights, whether it's from a search query, social media post, or even a GPS-enabled app. This wealth of location-based information enables businesses to refine their marketing strategies and create tailored solutions that cater to specific regions, ensuring that marketing campaigns are not just targeted but highly relevant. As the volume and precision of available data continue to rise, businesses can use this information to optimize their outreach and engage with customers in ways that were previously unimaginable.

With improved technologies like advanced data analytics and artificial intelligence (AI), businesses can now harness this massive flow of geospatial data more effectively. Sophisticated tools enable marketers to analyze consumer trends, regional patterns, and preferences in a granular and real-time manner, leading to better decision-making. As a result, the continuous increase in geospatial data availability remains a significant factor propelling the growth of the Geomarketing Market. Over 60% of companies across industries such as retail, real estate, and logistics are actively utilizing geospatial data for marketing purposes, to enhance location-based decision-making and target customers more effectively.

Key Market Challenges

Data Privacy and Security Concerns

One of the major challenges facing the Geomarketing Market is the growing concern around data privacy and security. As businesses increasingly rely on location-based data to drive marketing decisions, they are often collecting sensitive information about consumers, such as their exact whereabouts, movements, and personal preferences. This raises significant privacy concerns among customers, who may not be fully aware of how their data is being collected, stored, and utilized. The introduction of stricter data privacy regulations, such as the General Data Protection Regulation in the European Union and similar laws in other parts of the world, has added another layer of complexity for businesses using geomarketing strategies.For companies leveraging location-based data, ensuring that customer information is protected and used in compliance with privacy laws is critical. Failure to do so can result in significant legal repercussions, financial penalties, and reputational damage. Consumers are becoming increasingly sensitive to the sharing of their personal data, and any perceived misuse of their information can lead to a loss of trust in the brand. As a result, businesses must invest heavily in robust data security measures to prevent unauthorized access, breaches, and misuse of location data.

Beyond legal compliance, there is also the challenge of consumer consent. For businesses to use location data effectively, they need to obtain explicit consent from users, but many customers are reluctant to share their information due to privacy concerns. This creates a tension between offering personalized services and respecting user privacy. The growing trend of data anonymization and the use of aggregation techniques to protect individual identities may limit the depth of insights that businesses can gain from geospatial data. While this ensures privacy, it may reduce the effectiveness of geomarketing strategies. Companies will need to balance the demand for personalized marketing with the protection of consumer privacy in a way that adheres to legal frameworks and builds consumer trust.

Key Market Trends

Growing Adoption of Artificial Intelligence and Machine Learning in Geomarketing

One of the key trends driving the Geomarketing Market is the growing adoption of artificial intelligence and machine learning technologies. These advanced technologies are transforming how businesses analyze geospatial data and apply it to marketing strategies. By leveraging machine learning algorithms, companies can process vast amounts of location-based data to uncover hidden patterns, predict consumer behavior, and enhance the personalization of marketing campaigns.Artificial intelligence allows for deeper insights into customer preferences and trends by analyzing historical data and identifying correlations between geographic location and purchasing behavior. For instance, machine learning can help businesses determine the most effective time and location for launching promotions or advertisements, maximizing their impact. AI-powered tools can automate tasks such as customer segmentation, improving targeting accuracy and reducing human error.

Machine learning models enable predictive analytics, which helps businesses forecast customer behavior and make data-driven decisions about resource allocation. This can be particularly valuable for companies looking to optimize store locations, supply chain management, and marketing strategies based on geographic data. The integration of artificial intelligence and machine learning into geomarketing platforms enhances the ability to offer real-time, personalized experiences for customers. By automating and optimizing marketing processes, businesses can improve efficiency, increase customer engagement, and drive higher conversion rates. As AI and machine learning technologies continue to evolve, their role in geomarketing is expected to grow, further solidifying their position as a major trend in the sector.

Key Market Players

- Google LLC

- Oracle Corporation

- SAP SE

- Environmental Systems Research Institute, Inc. (Esri)

- Pitney Bowes Inc.

- HERE Global B.V.

- TomTom N.V.

- Precise Software Solutions, Inc.

- Maxar Technologies Inc.

- CartoDB Inc.

Report Scope:

In this report, the Global Geomarketing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Geomarketing Market, By Component:

- Software

- Service

Geomarketing Market, By Deployment Mode:

- Cloud

- On-premises

Geomarketing Market, By End Use:

- BFSI

- IT & Telecom

- Retail & E-Commerce

- Media & Entertainment

- Travel & Hospitality

- Others

Geomarketing Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Belgium

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Vietnam

- South America

- Brazil

- Colombia

- Argentina

- Chile

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Geomarketing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Google LLC

- Oracle Corporation

- SAP SE

- Environmental Systems Research Institute, Inc. (Esri)

- Pitney Bowes Inc.

- HERE Global B.V.

- TomTom N.V.

- Precise Software Solutions, Inc.

- Maxar Technologies Inc.

- CartoDB Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.79 Billion |

| Forecasted Market Value ( USD | $ 76.51 Billion |

| Compound Annual Growth Rate | 23.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |