Indonesia Halal Hair Care Market Growth & Trends

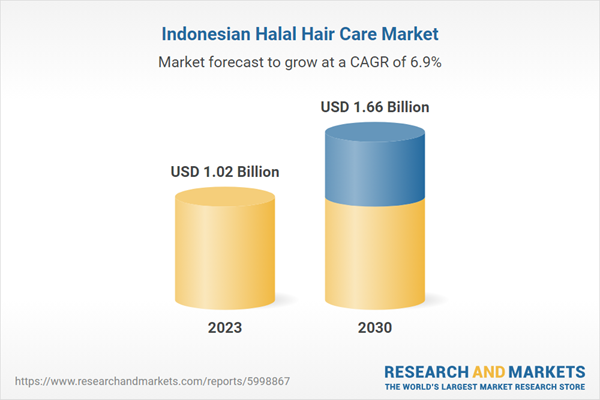

The Indonesia halal hair care market size is anticipated to reach USD 1.66 billion by 2030, expanding at a CAGR of 6.9% from 2024 to 2030. Increasing preference among the Islamic population regarding ethical consumption of beauty products has contributed largely to industry growth in recent years.Additionally, rising demand for organic and vegan-friendly products by the consumers owing to increasing awareness regarding the detrimental impacts of chemical-based products has also driven more positive outlook for halal products in the region and across the globe.

Indonesia also proposed a law stating that all products must be halal certified by 2019. This has created huge potential for these personal care products, encouraging numerous multinational cosmetic brands to launch certified products. Expanding middle-class population and their willingness to pay premium prices for quality products has also had a positive influence on industry growth as well.

The demographic structure of the country, comprising of over 60% youth, has proved beneficial for importers and manufacturers of hair care products. Young people are attracted to innovative products as they support their ethical beliefs & changing lifestyles. Labels such as organic, animal cruelty-free, and vegan are not only influencing the Islamic, but also the overall population in the country.

Shampoos were the dominant product category in 2015, with over 33% of the revenue share in 2015 and expected to grow at a rapid pace over the forecast period. Hijab-wearing women often face issues such as dandruff, hair-fall and limp, dull, lifeless hair, which are being targeted using specific shampoos containing natural ingredients.

Indonesia Halal Hair Care Market Report Highlights

- Shampoo dominated the market with the largest revenue share of 33.4% in 2023. Females widely use halal anti-dandruff shampoo for the treatment of specific complications, itchy scalp, issues such as dandruff, hair-fall, and limp, dull, lifeless hair, are aimed using particular and branded shampoos having natural and herbal ingredients.

- Conditioners are expected to grow at a CAGR of 7.2% over the projected years. They offer benefits to overcome hair issues by enhancing texture, volume, smoothness, and nourishment.

- Hypermarkets & supermarkets led the market and accounted for the largest revenue share of 40.6% in 2023. It is now easier for customers to obtain halal-certified hair care products due to their increased exposure and availability at these sizable retail establishments.

- Online distribution channels have experienced growth with a CAGR of 10.6% in projected years. The surge online has had a significant impact on how plates are distributed.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- Unilever

- L'Oréal Paris

- Wardah

- Sariayu Cosmetics

- Procter & Gamble

- CLARA INTERNATIONAL BEAUTY GROUP

- Iba Halal

- PHB Ethical Beauty Ltd.

- PT Paragon Technology and Innovation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | August 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 1.02 Billion |

| Forecasted Market Value ( USD | $ 1.66 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Indonesia |

| No. of Companies Mentioned | 9 |